A case study on building a tool to manage investment portfolio

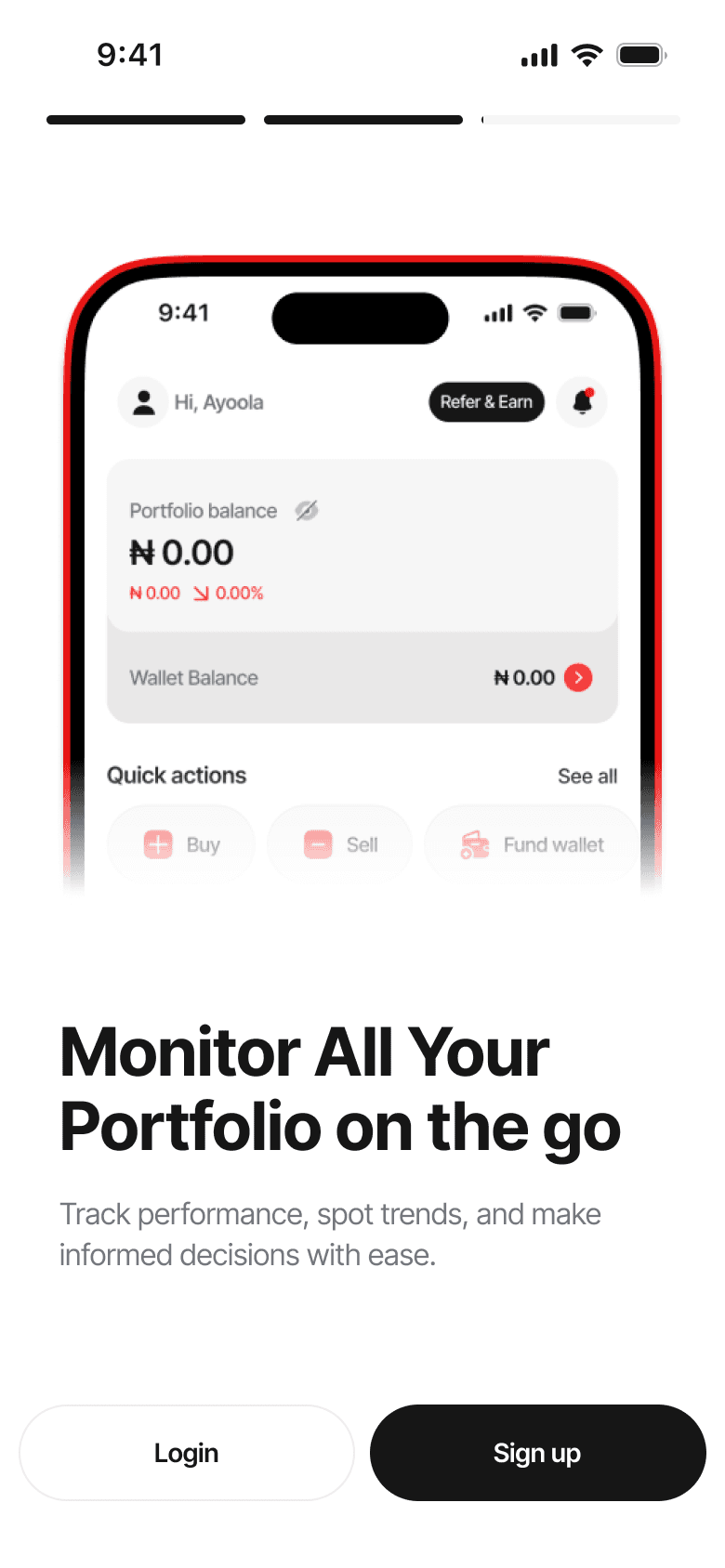

Onboarding Carousel

Each onboarding screen has consistent CTAs at the bottom: "Login" (dark button) and "Sign up" (white button), making it easy for users to take action at any point in the flow.

Sign-up/registration flow

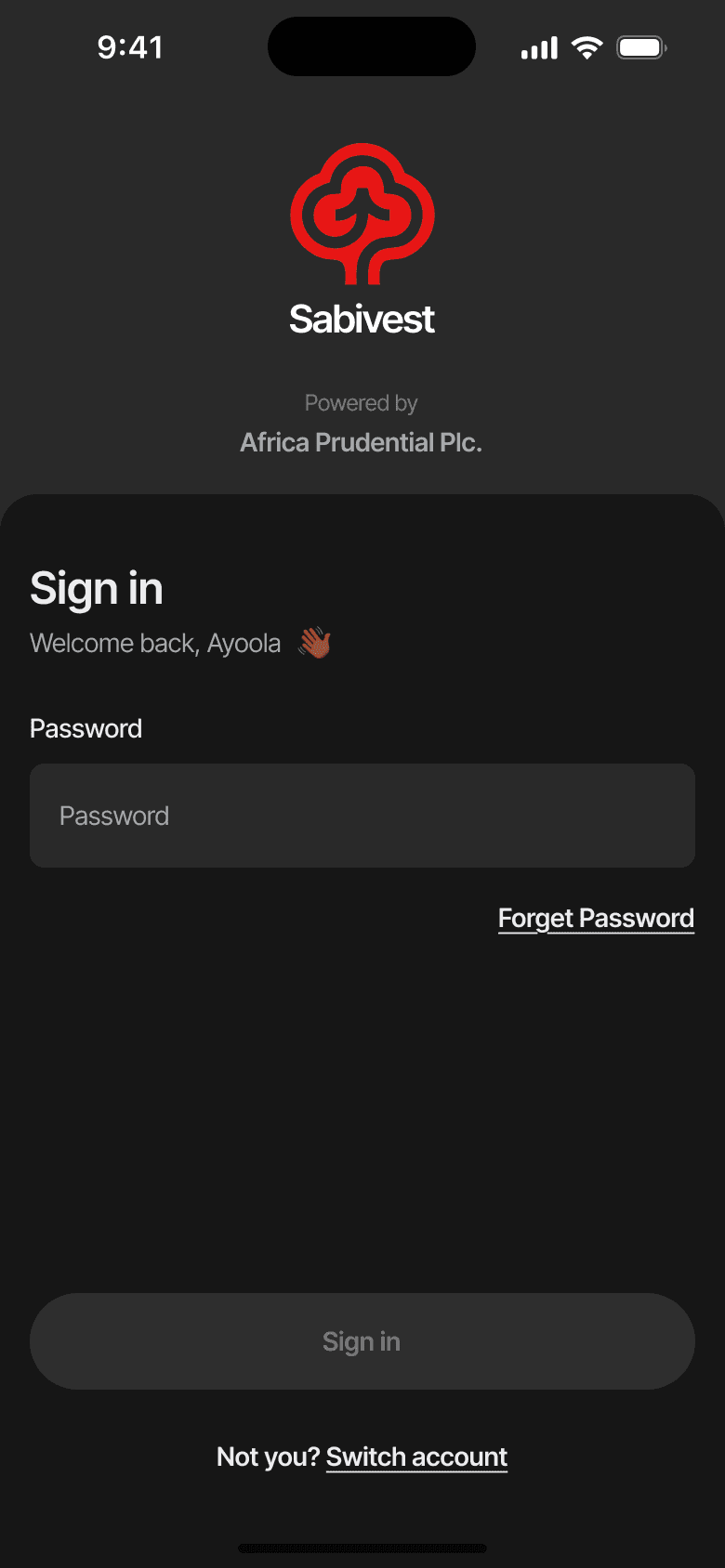

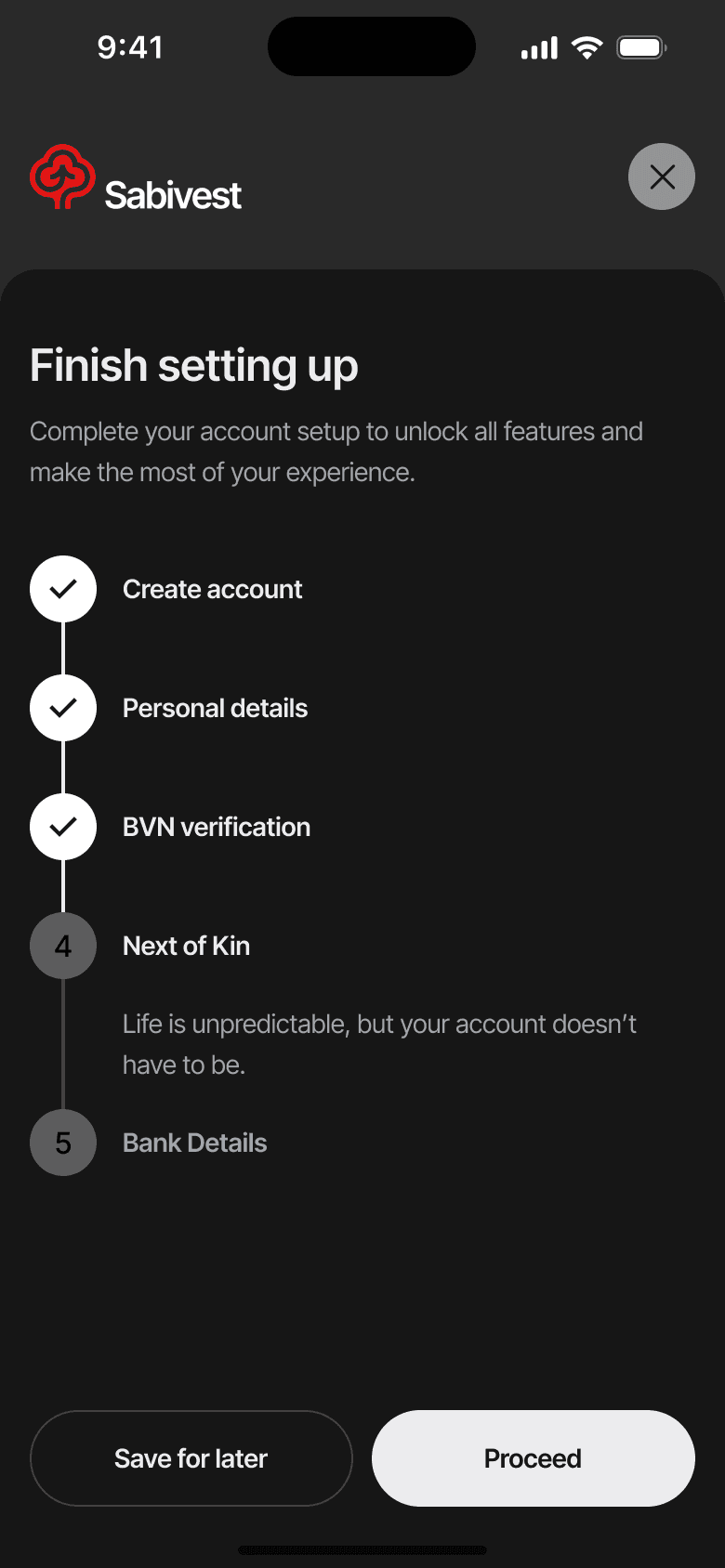

The flow demonstrates good UX practices with progressive disclosure, clear validation feedback, and the ability to navigate backward through steps. The dark mode variant shows the same functionality with inverted color scheme for better visibility in low-light conditions.

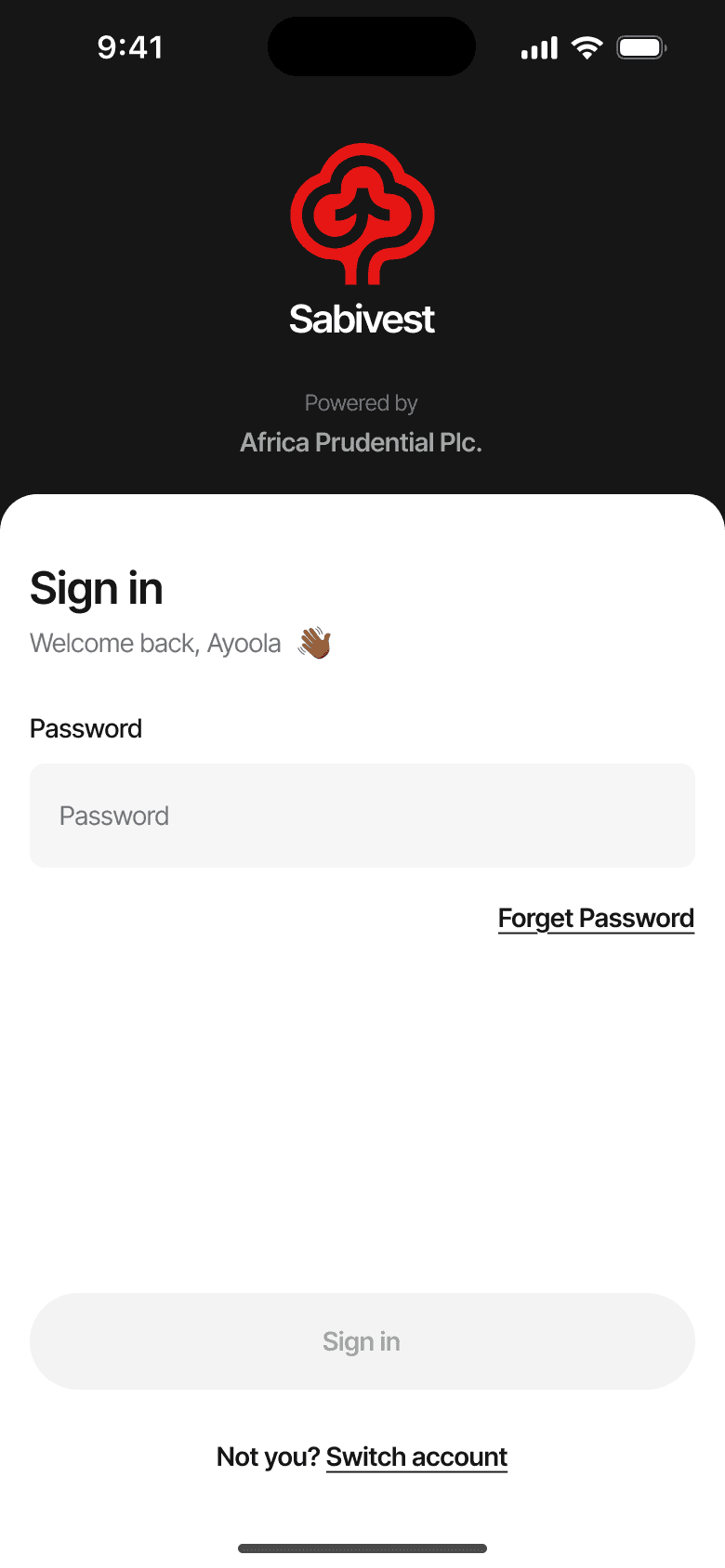

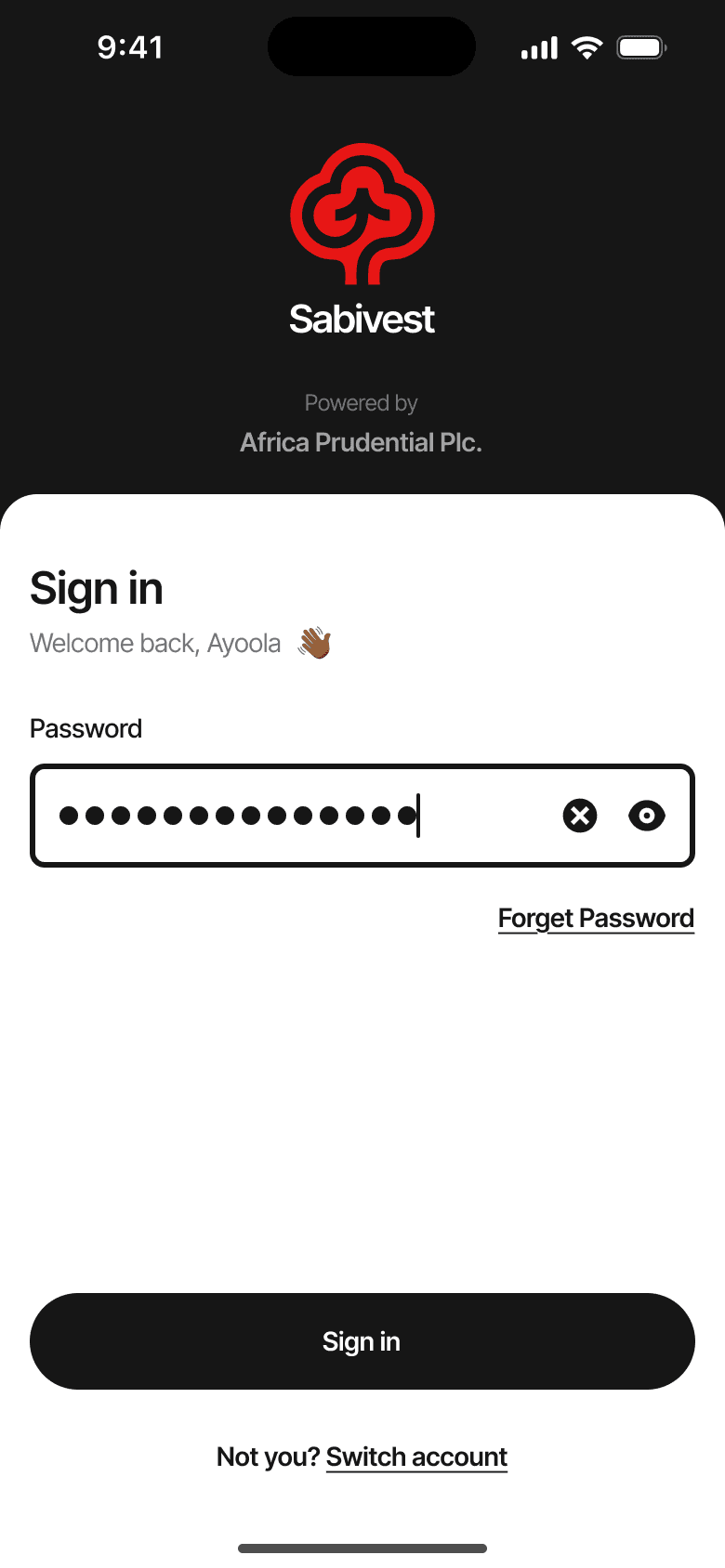

Login flow

This is a returning user flow (not first-time registration), as evidenced by the "Welcome back" messaging and the ability to switch accounts.

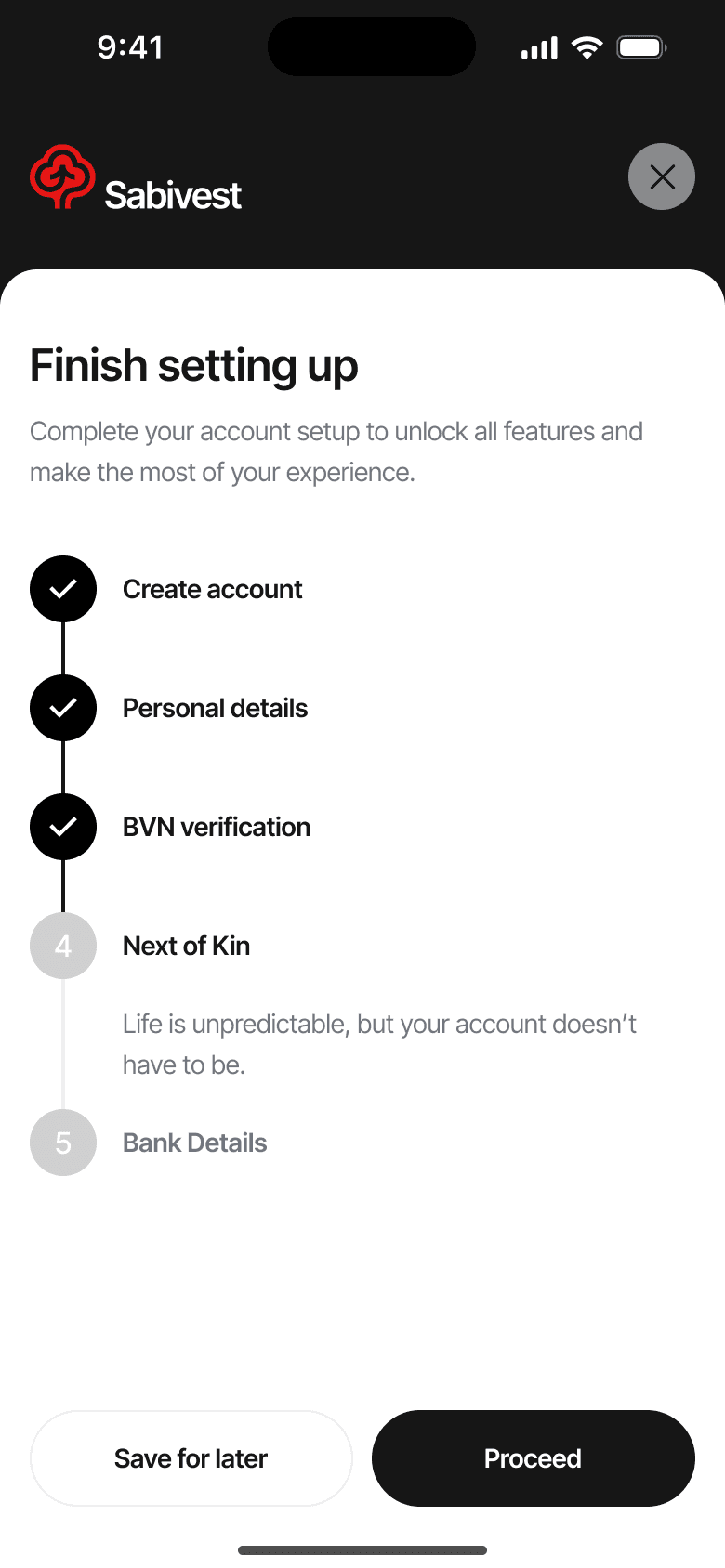

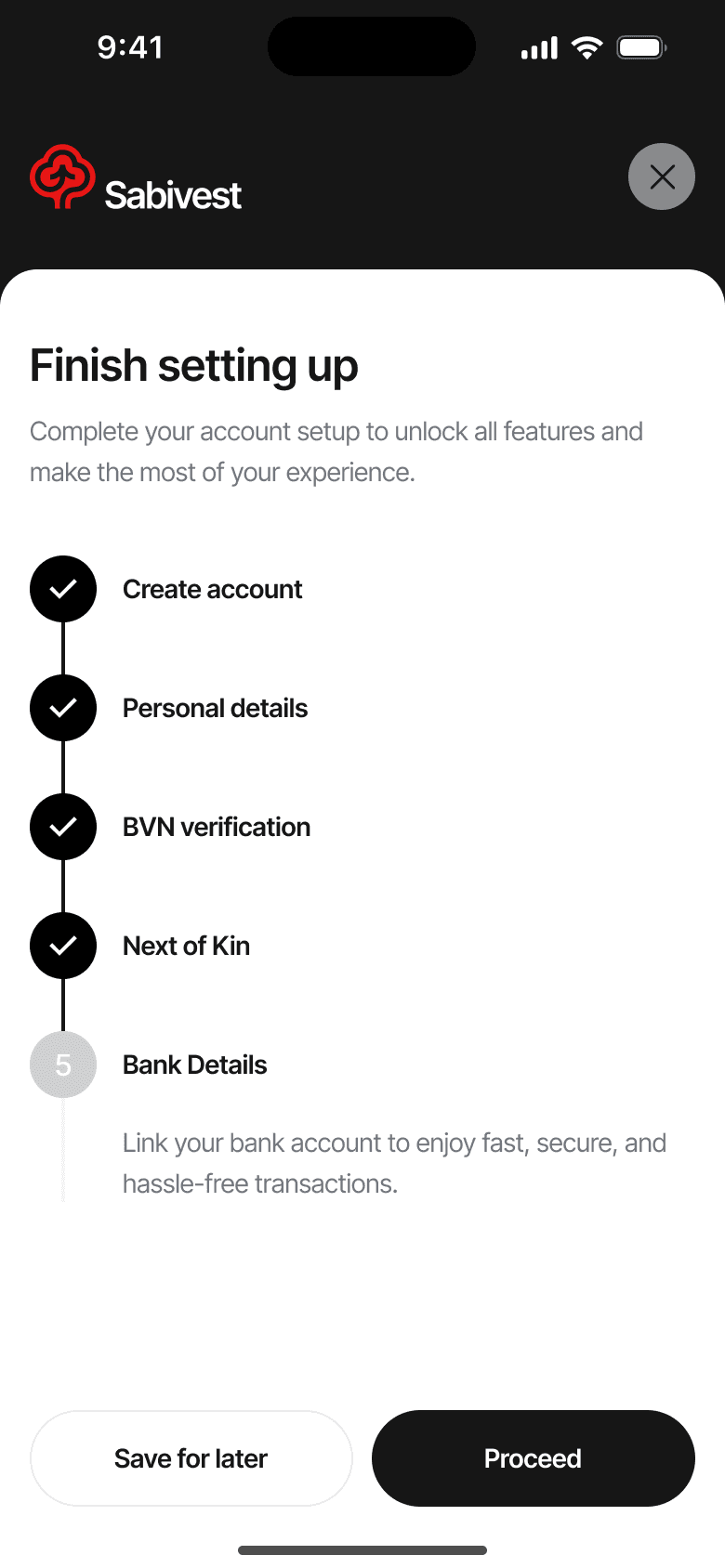

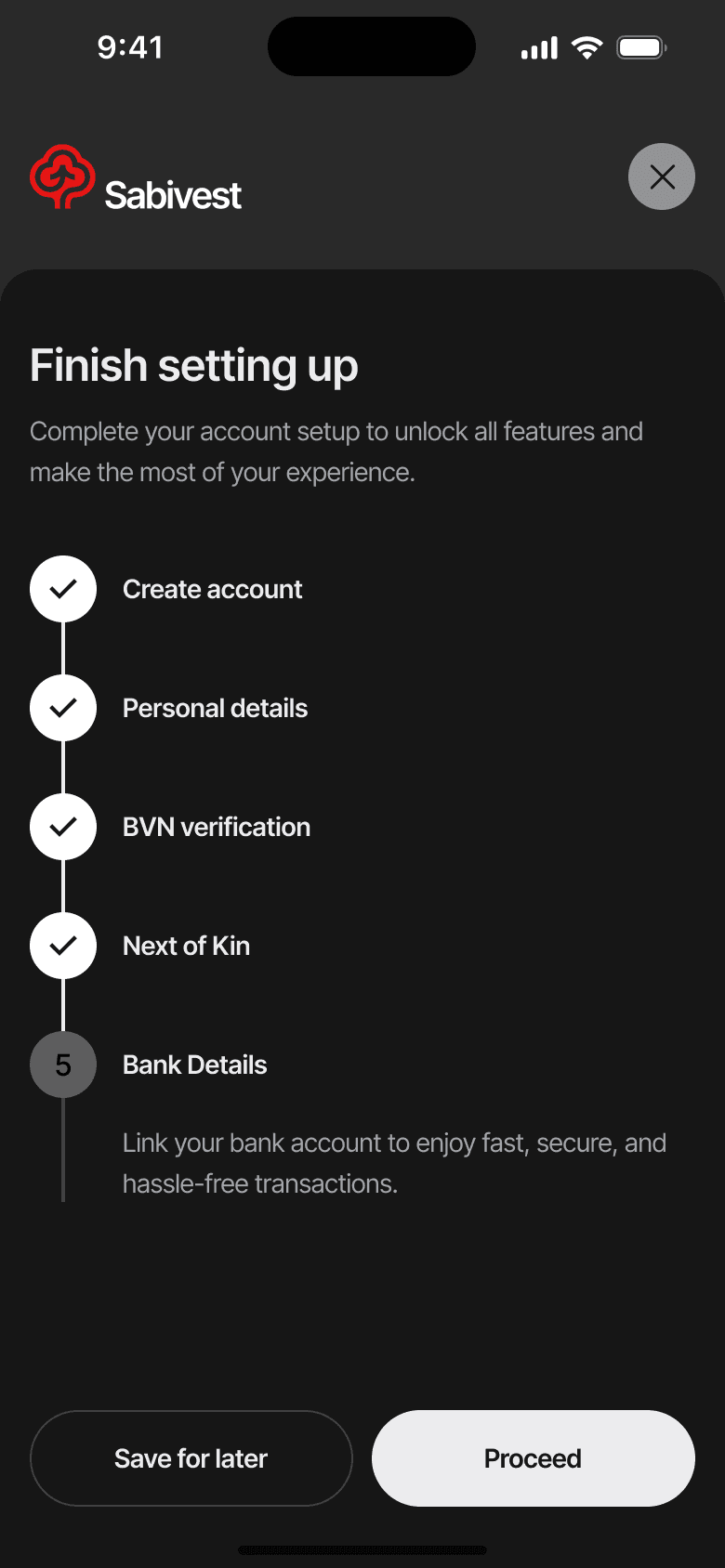

Onboarding checklist flow

It's a progressive completion interface showing users the steps needed to fully set up their SabIvest account.

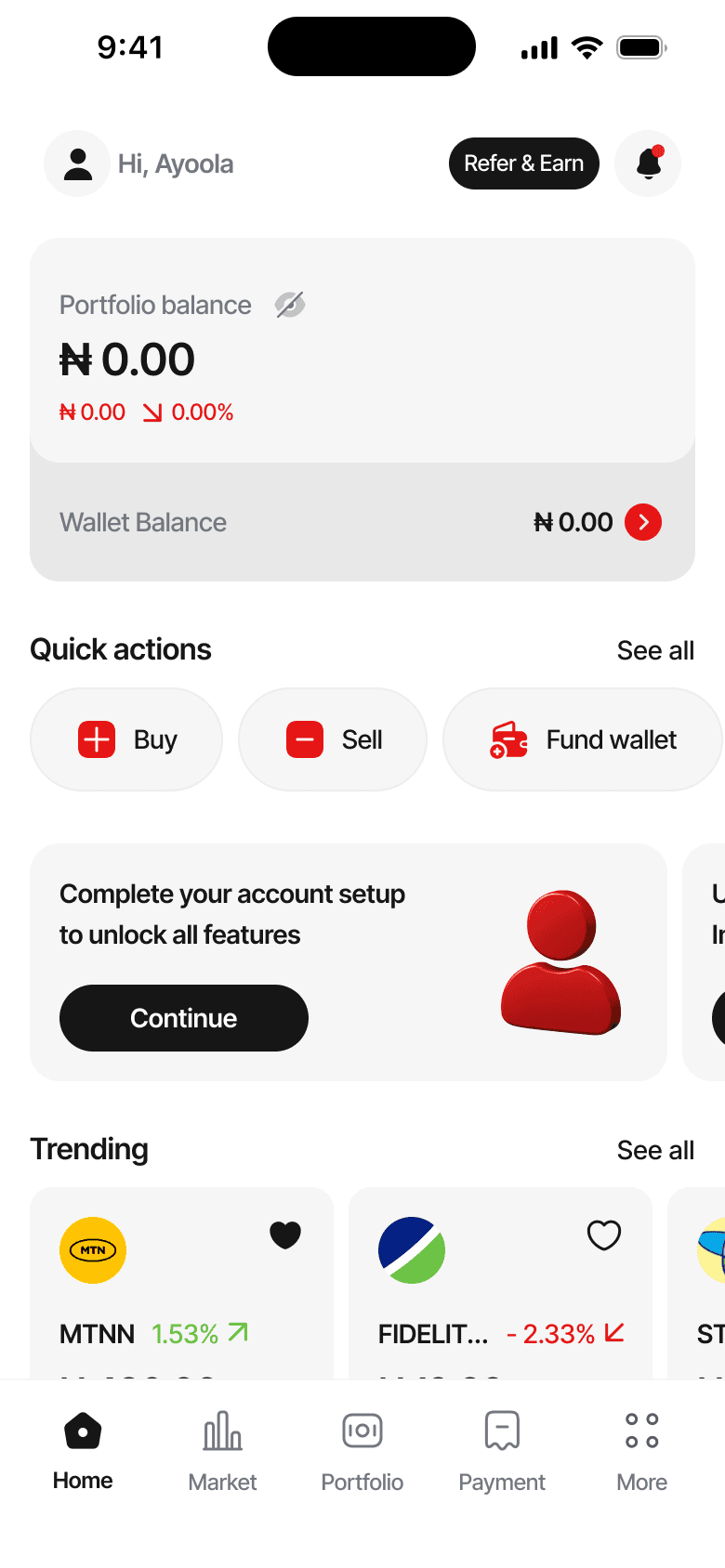

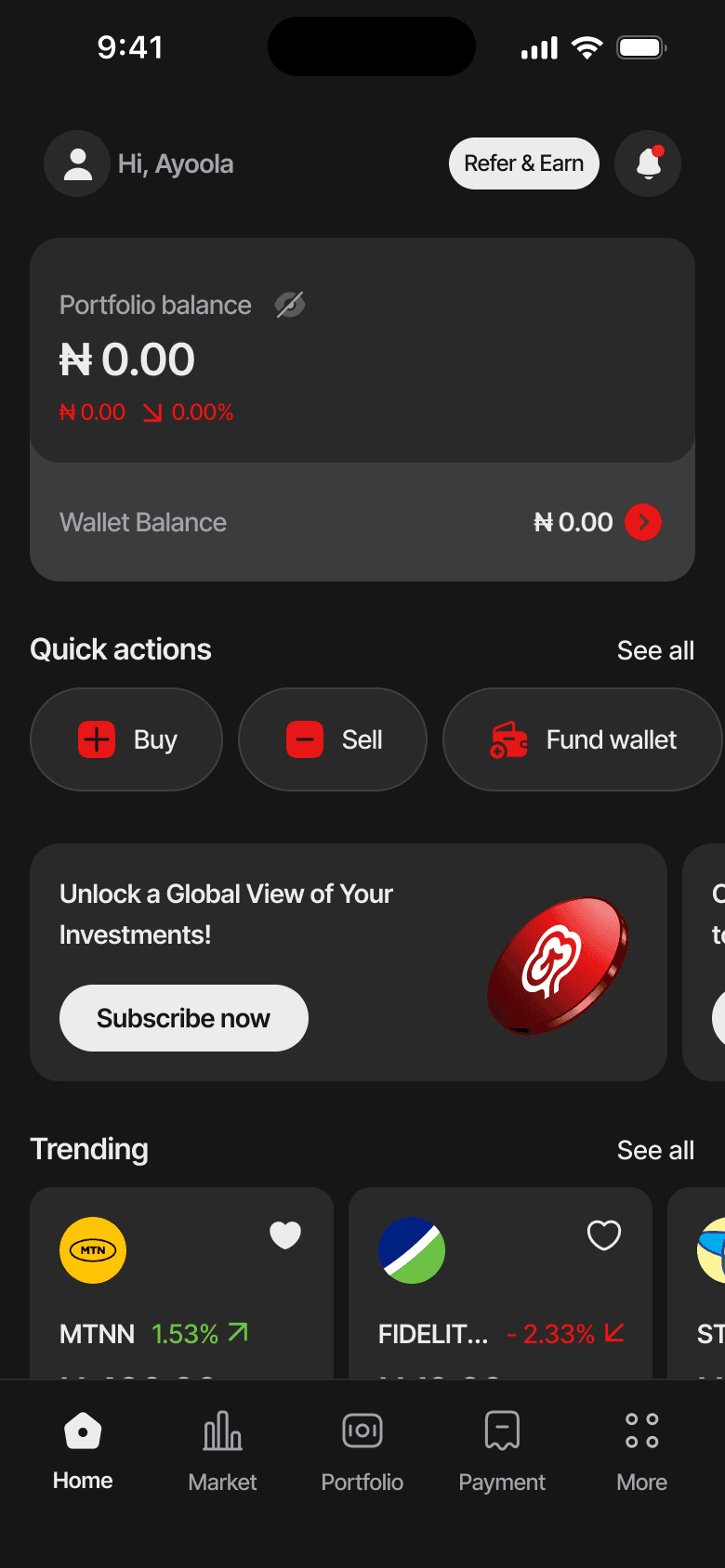

Home screen (Dashboard)

This dashboard follows a card-based layout common, providing quick access to key actions while displaying portfolio performance and market trends at a glance.

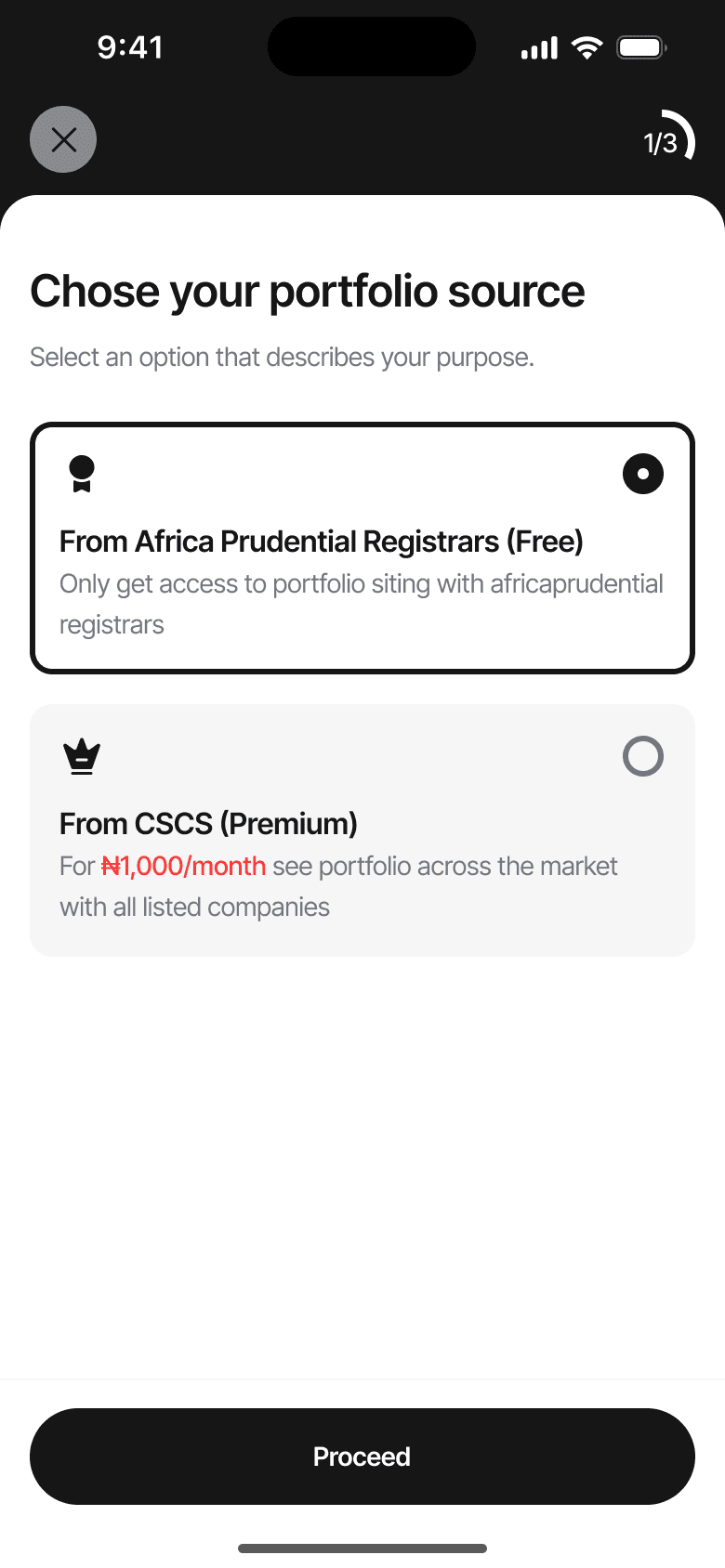

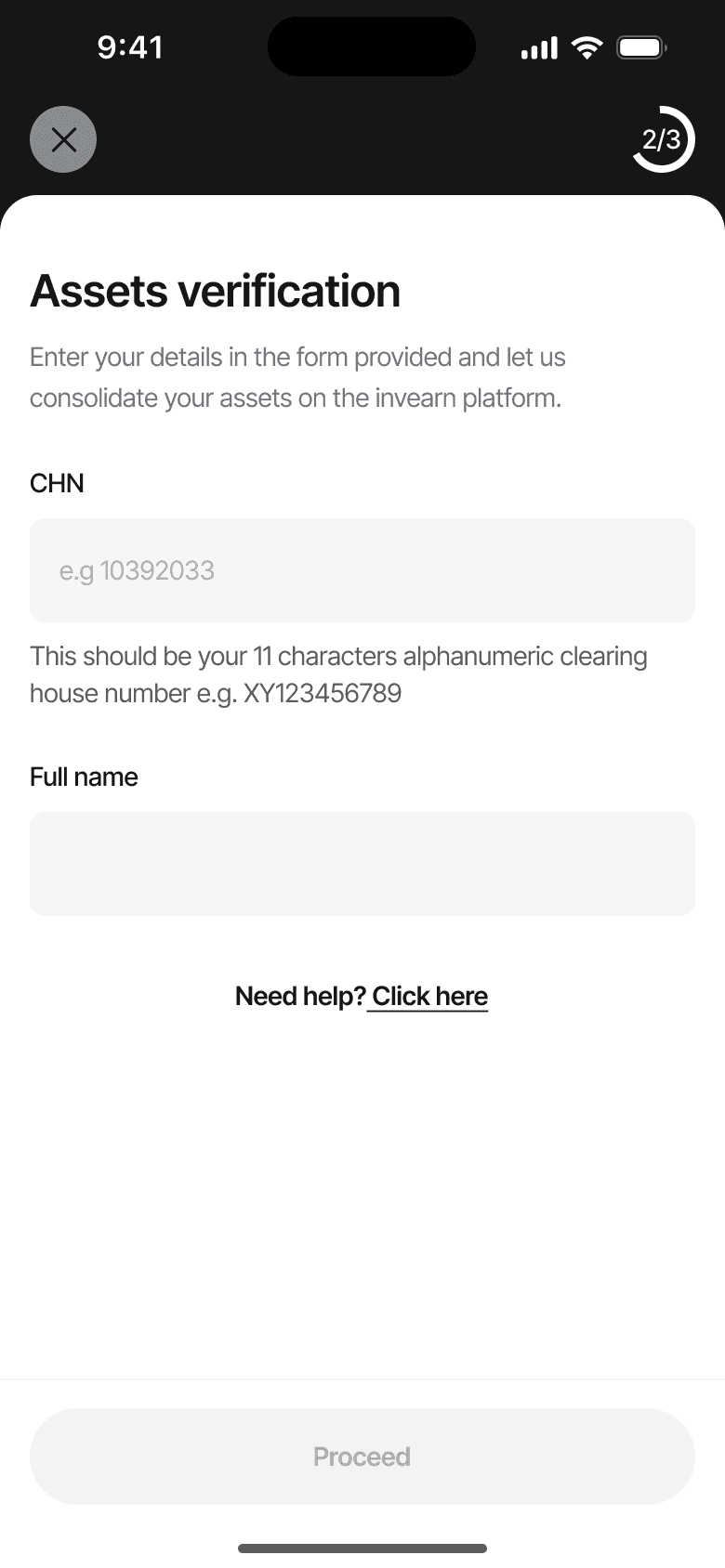

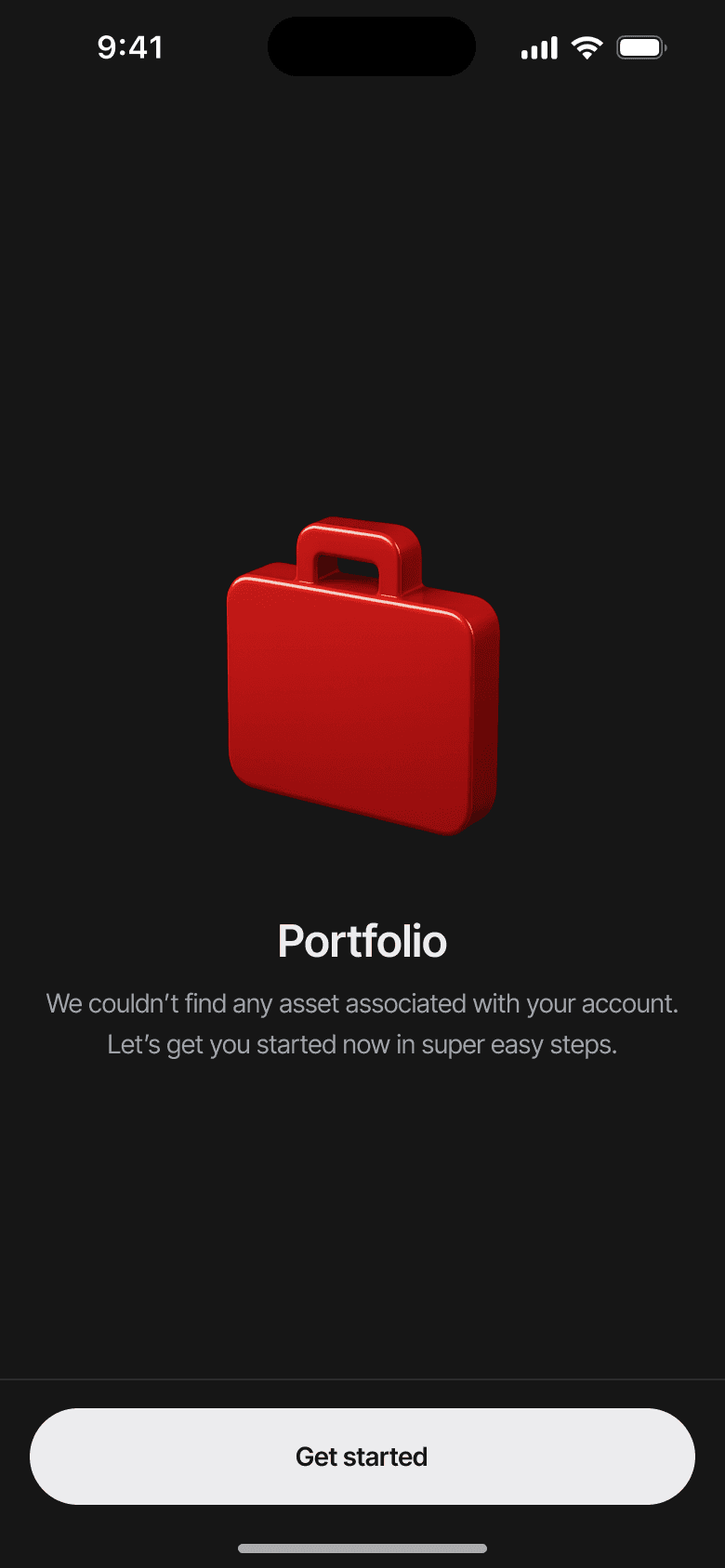

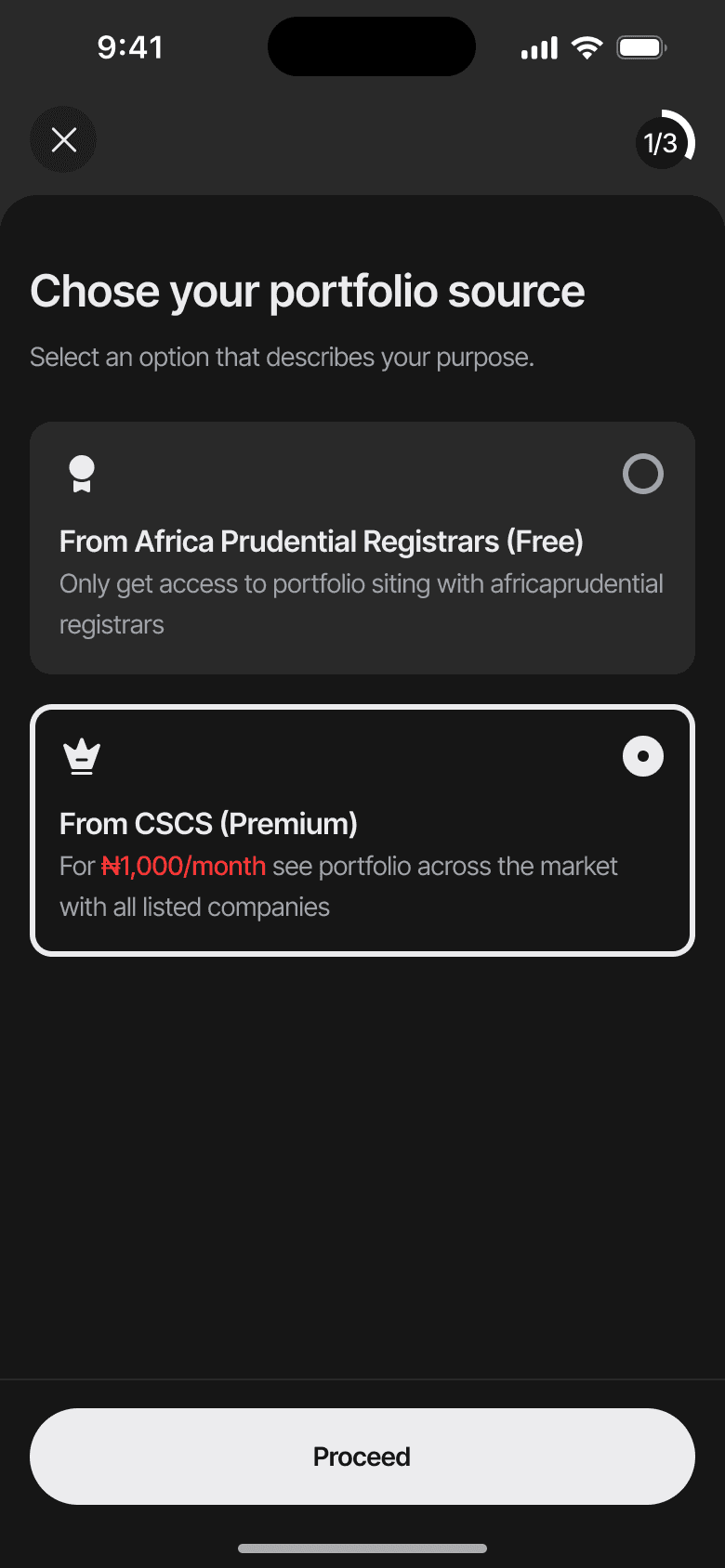

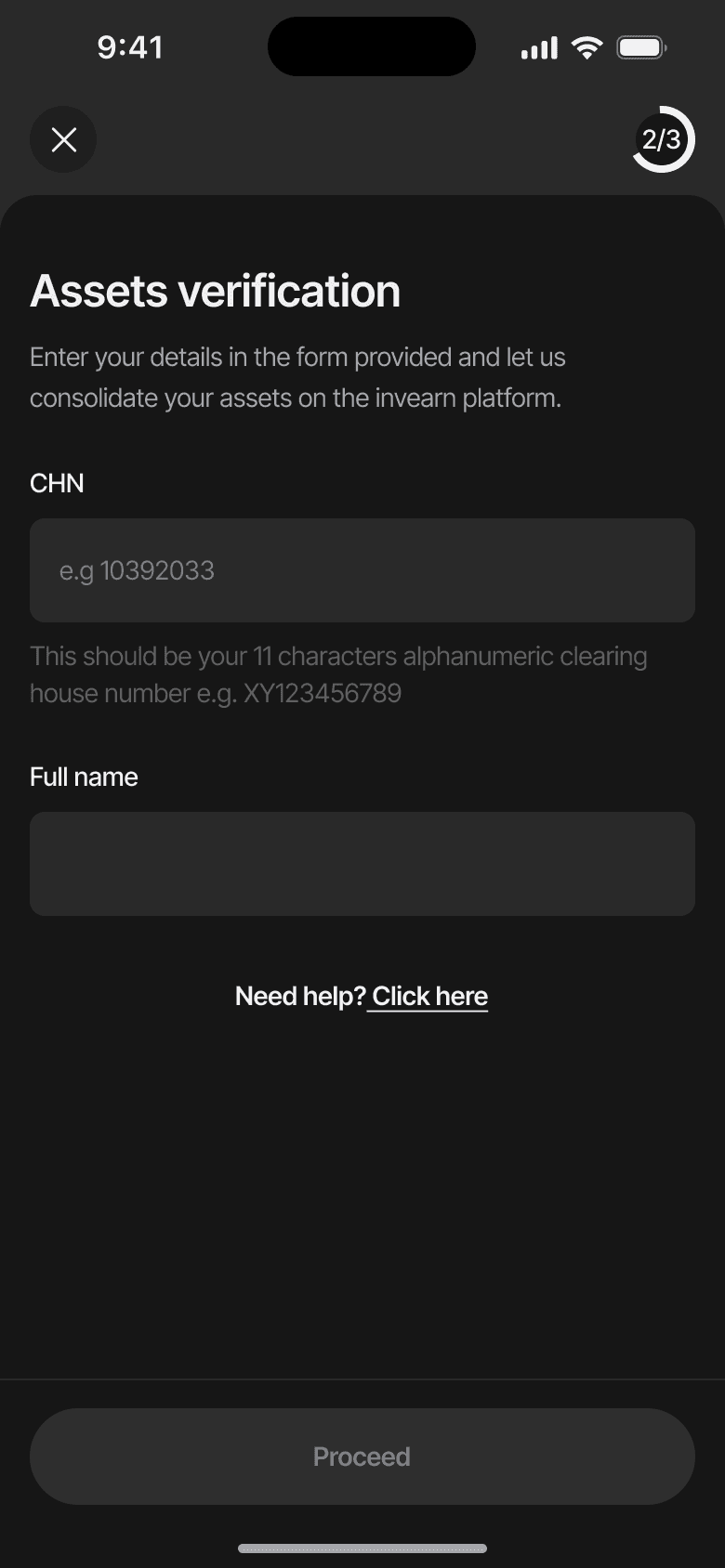

Portfolio import/migration flow

This enables users to eliminates manual entry of existing holdings and provides immediate portfolio visibility, reducing friction for users migrating from traditional registrar systems to the digital platform.

Portfolio import/migration flow

This enables users to eliminates manual entry of existing holdings and provides immediate portfolio visibility, reducing friction for users migrating from traditional registrar systems to the digital platform.

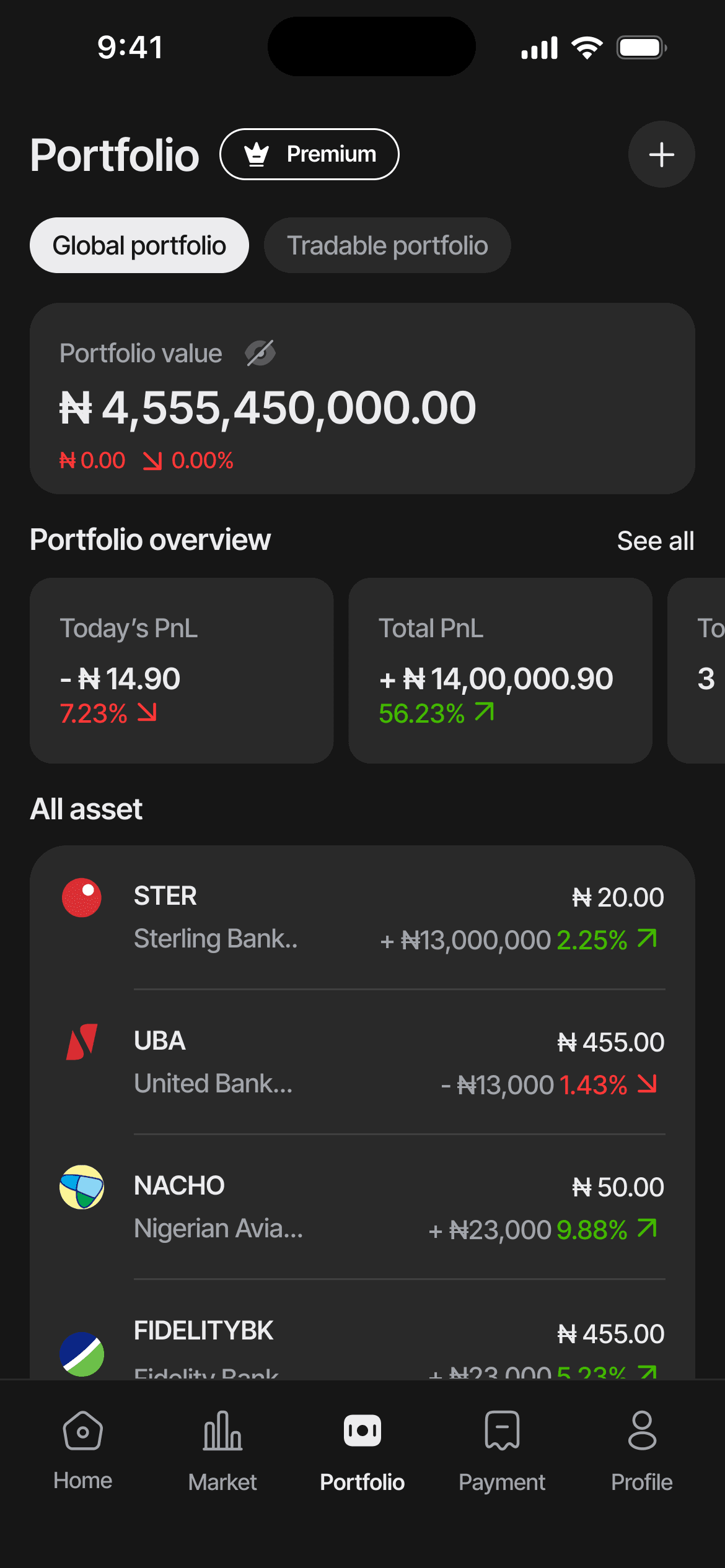

Portfolio Overview

This portfolio interface effectively balances comprehensive data display with usability, showing high-level performance metrics while allowing drill-down into individual assets.

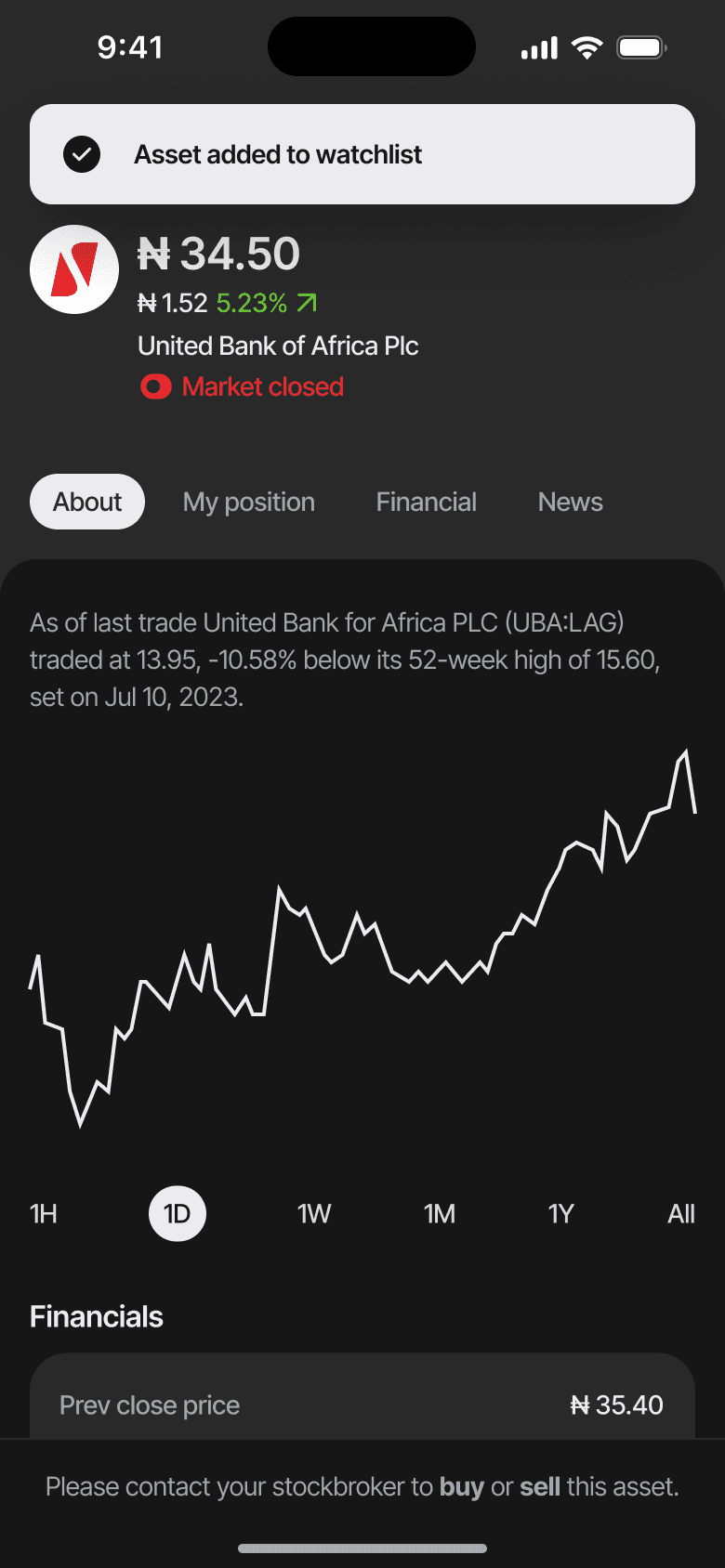

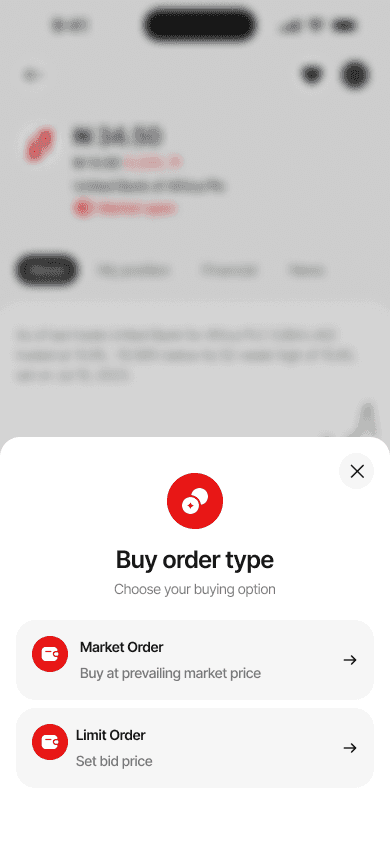

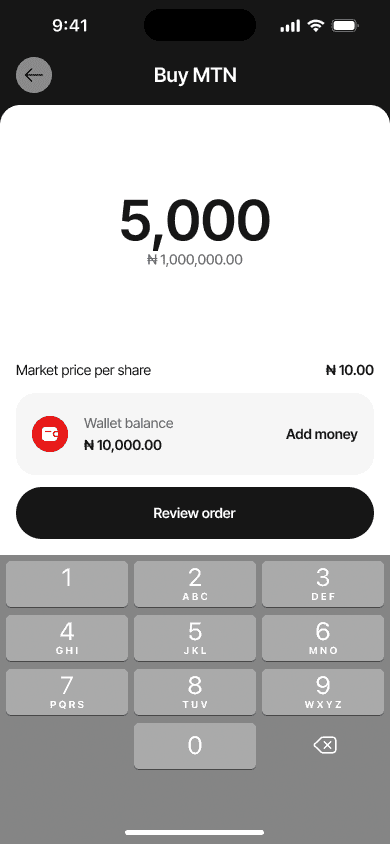

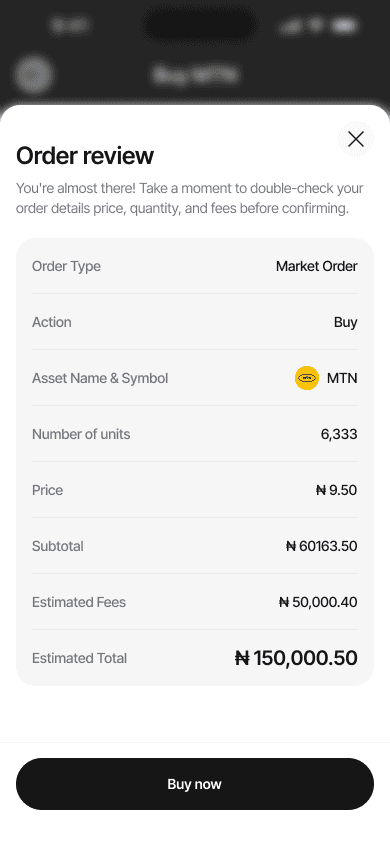

Stock trading/purchase flow

This flow balances simplicity with necessary safeguards, making it easy to buy stocks while preventing costly mistakes through the confirmation step.

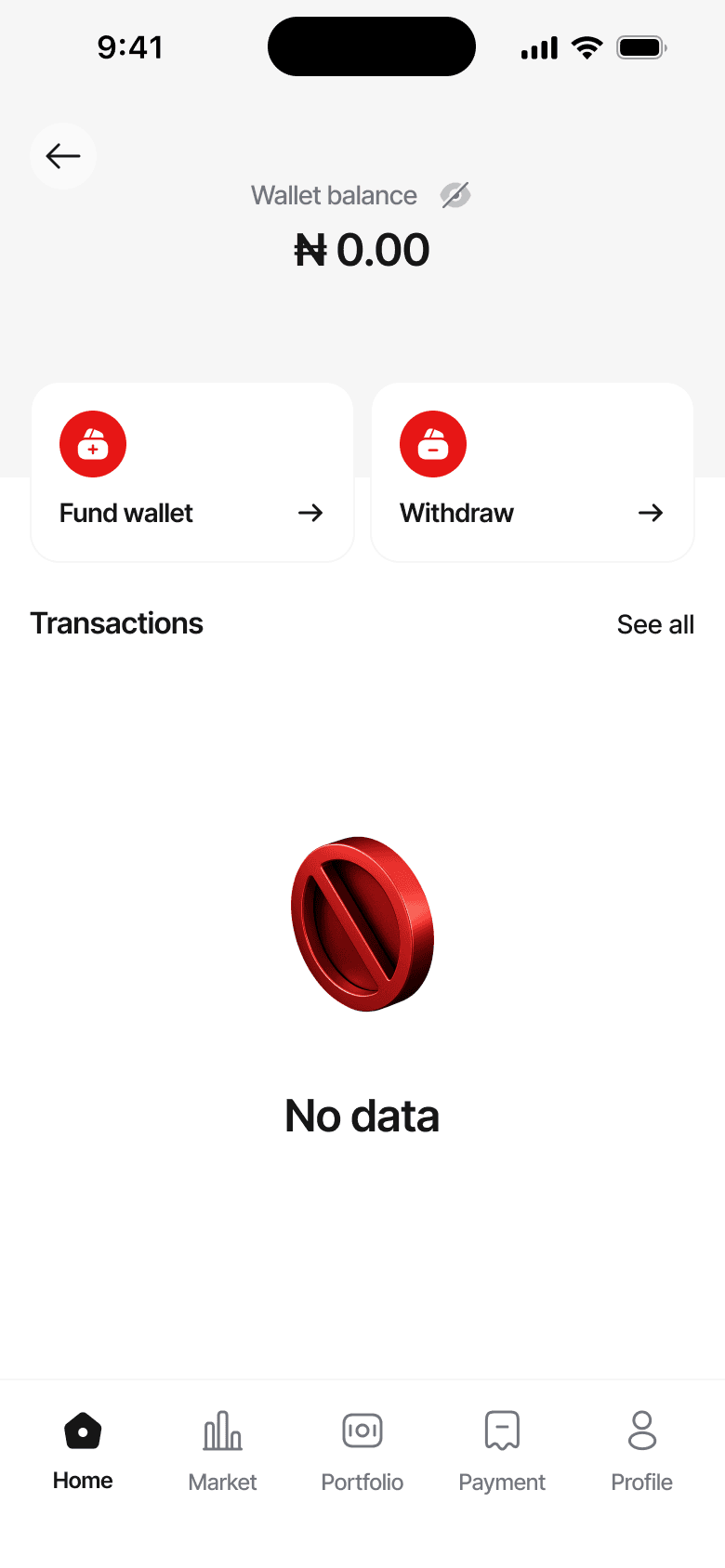

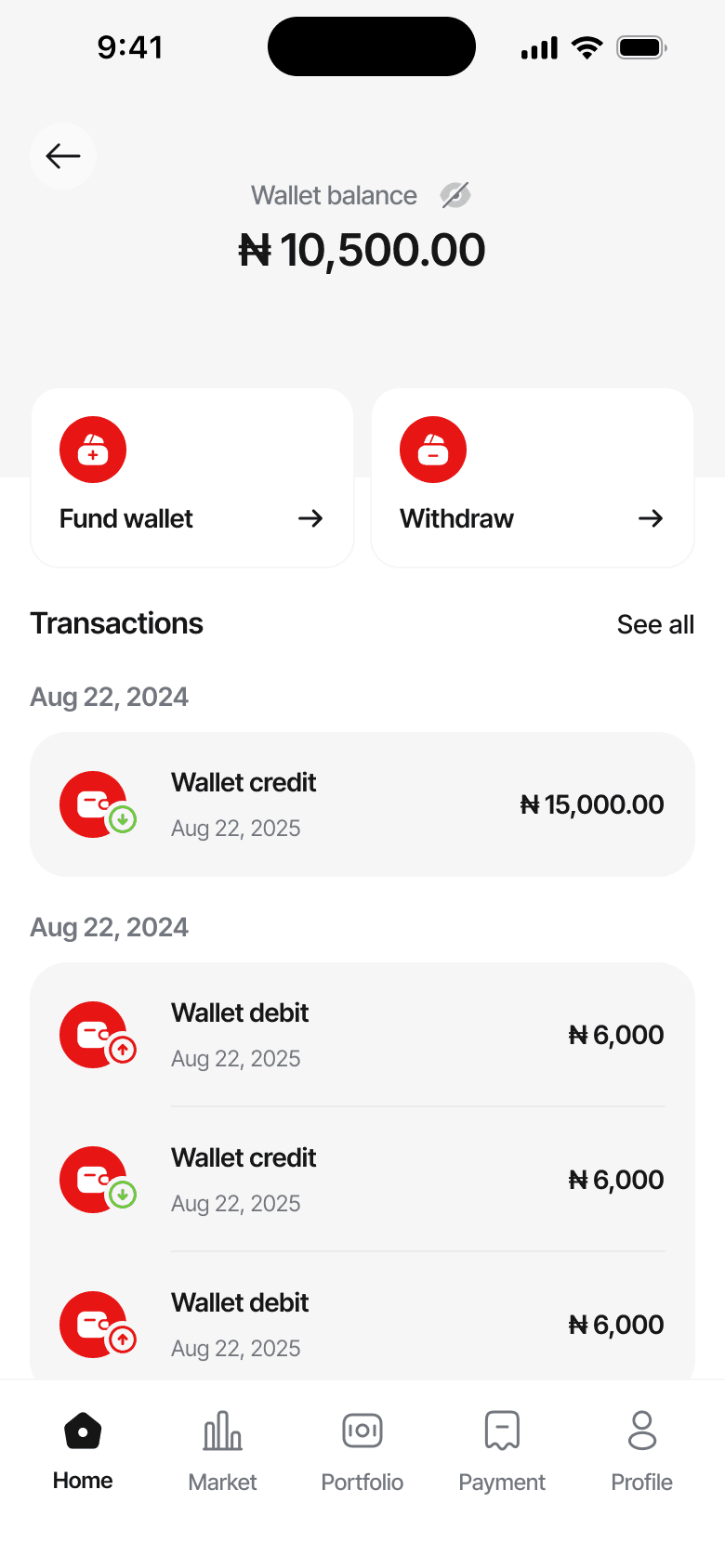

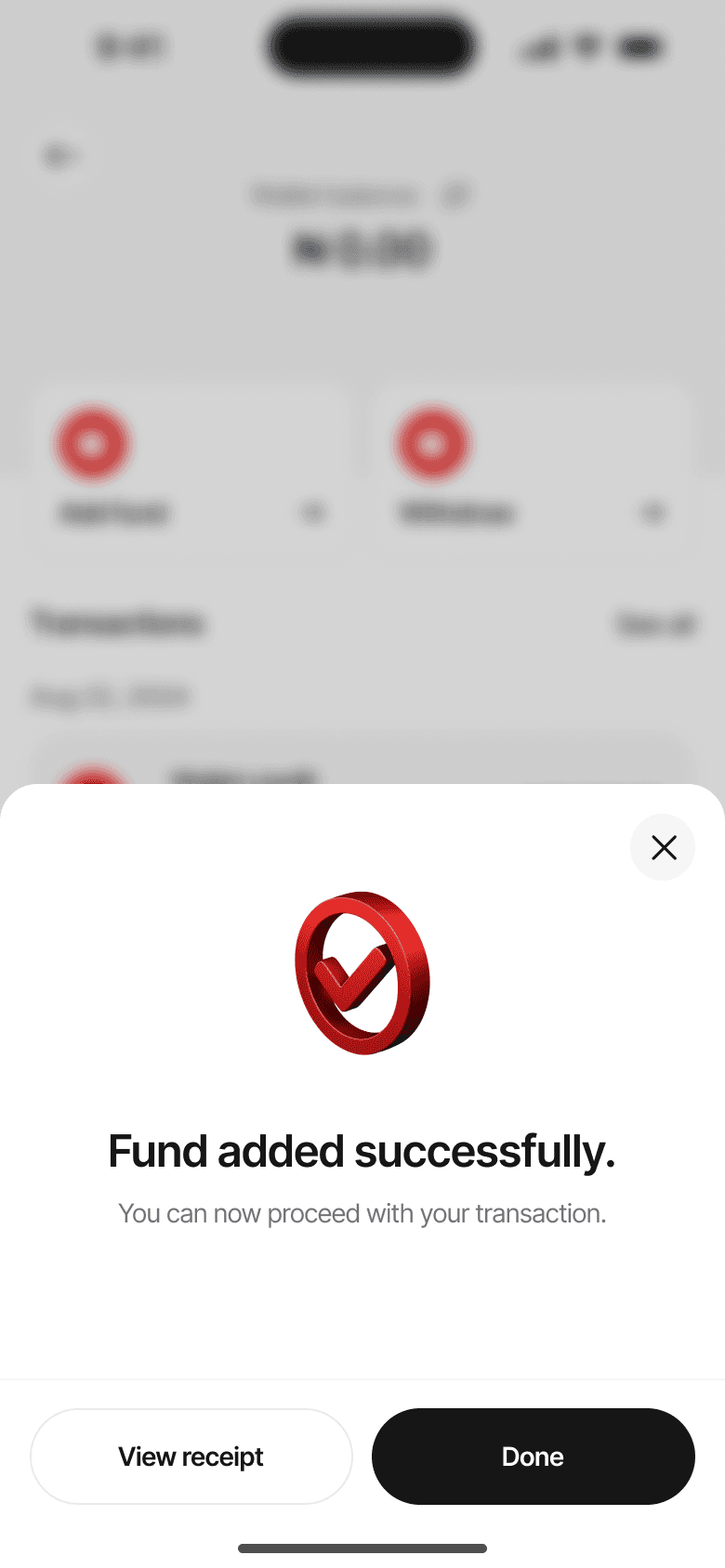

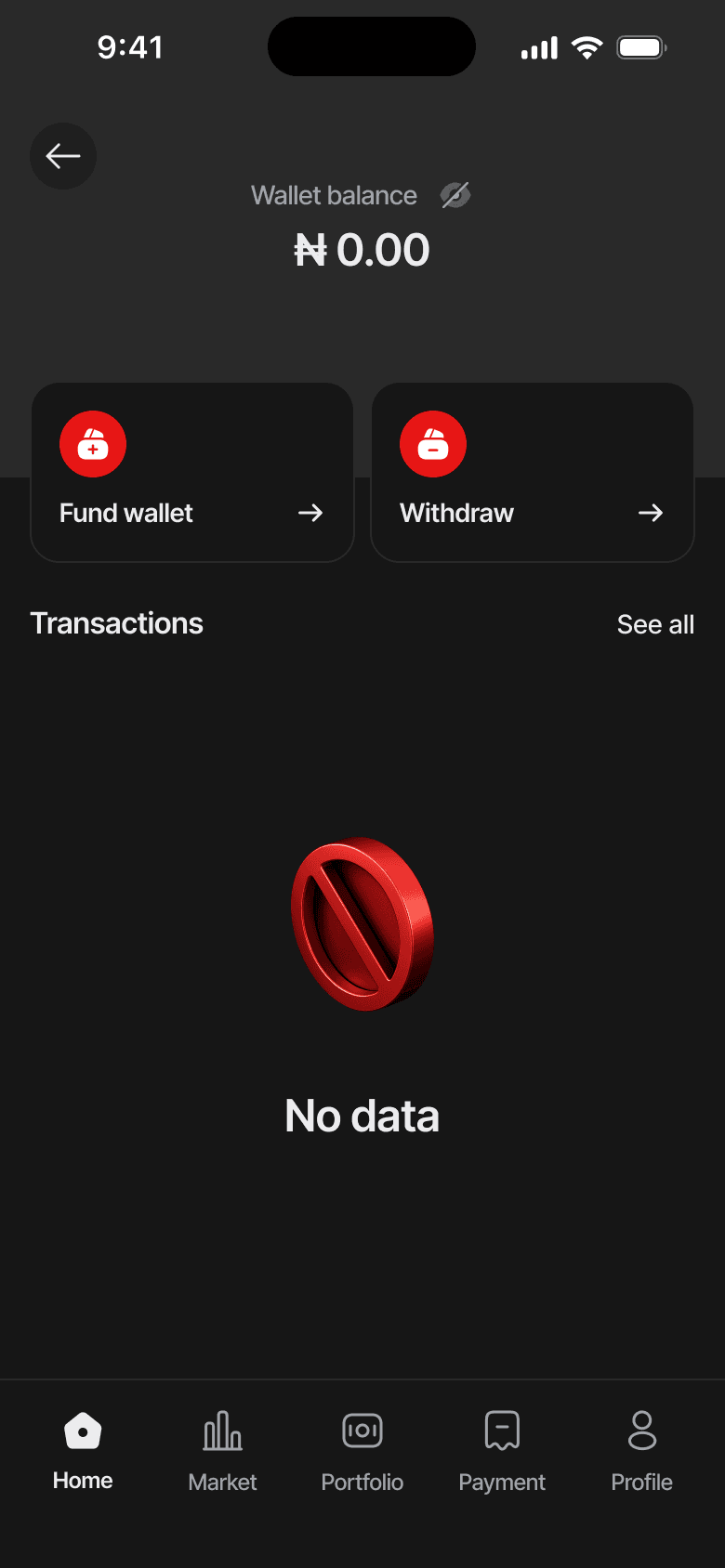

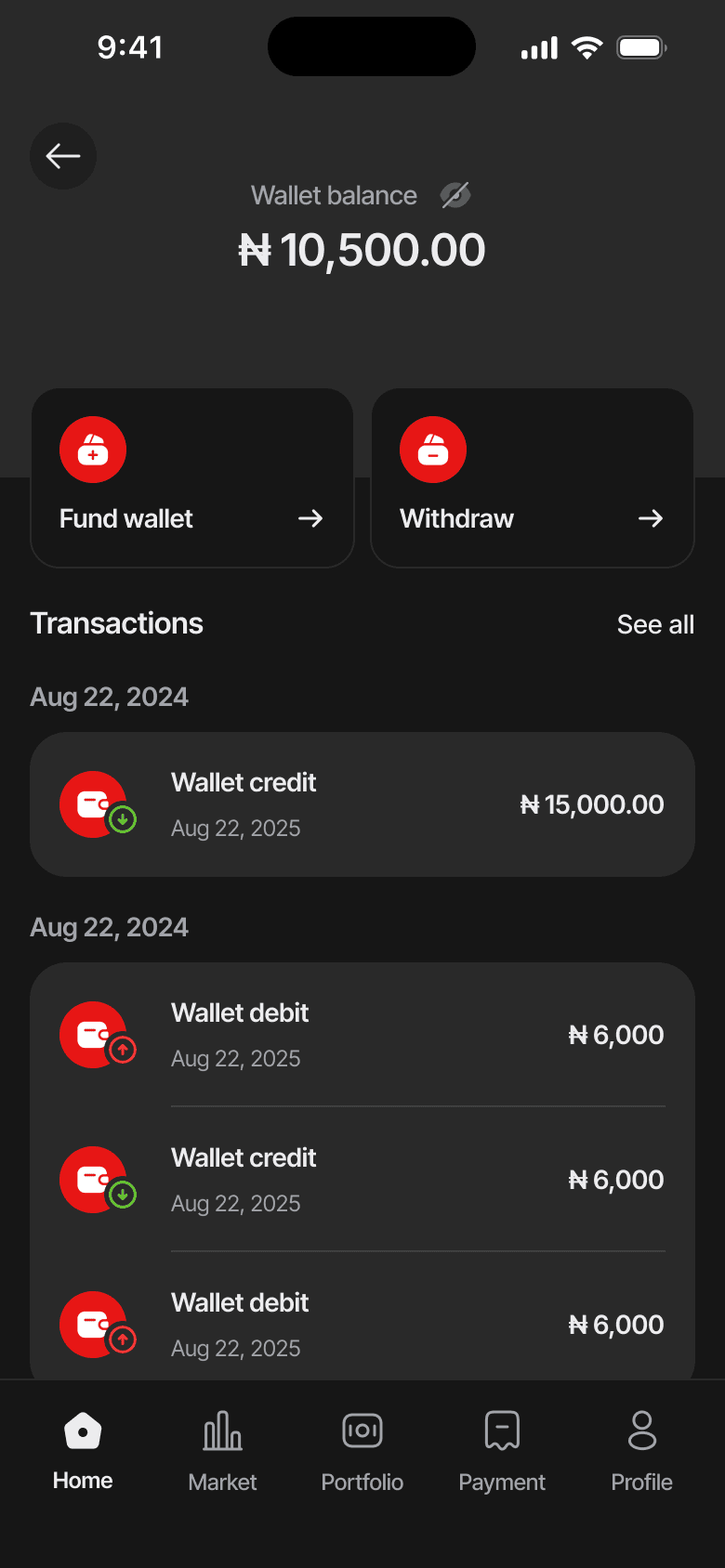

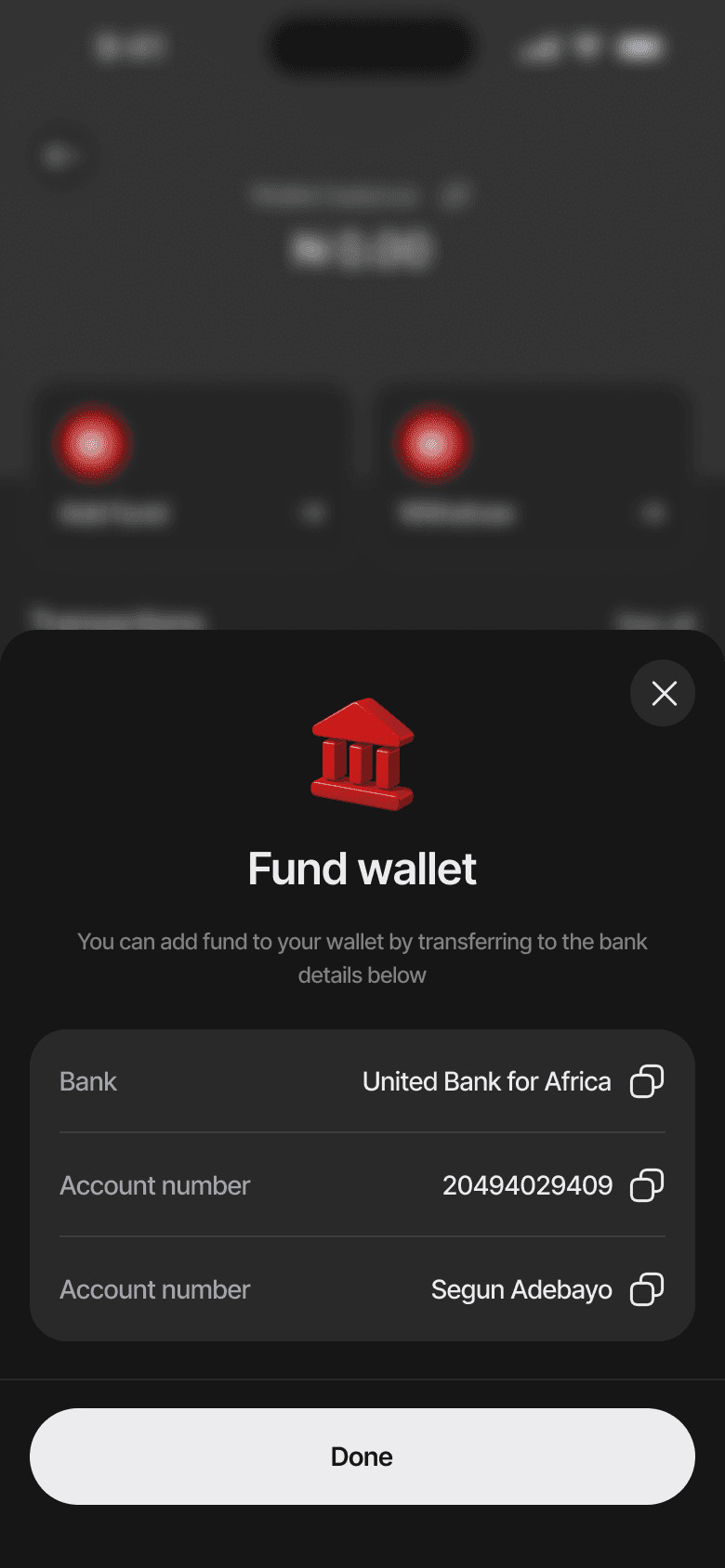

Wallet

This is a virtual account top-up system common in Nigerian fintech apps. Users receive dedicated bank account details and can fund their wallet via bank transfer from any Nigerian bank. The system automatically detects incoming transfers and credits the wallet